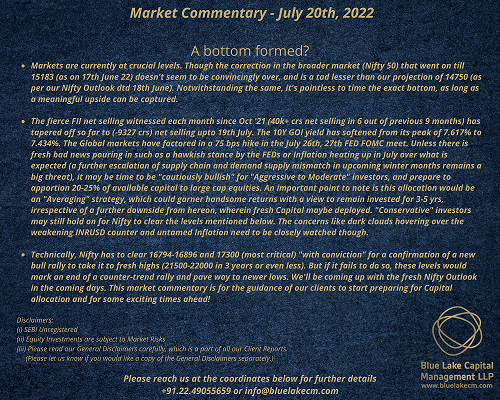

July 20th, 2022 – A bottom formed?

Markets are currently at crucial levels. Though the correction in the broader market (Nifty 50) that went on till 15183 (as on 17th June 22) doesn’t seem to be convincingly over, and is a tad lesser than our projection of 14750 (as per our Nifty Outlook dtd 18th June). Notwithstanding the same, it’s pointless to time the exact bottom, as long as a meaningful upside can be captured.

The fierce FII net selling witnessed each month since Oct ’21 (40k+ crs net selling in 6 out of previous 9 months) has tapered off so far to (-9327 crs) net selling upto 19th July.

The 10Y GOI yield has softened from its peak of 7.617% to 7.434%. The Global markets have factored in a 75 bps hike in the July 26th, 27th FED FOMC meet. Unless there is fresh bad news pouring in such as a hawkish stance by the FEDs or Inflation heating up in July over what is expected (a further escalation of supply chain and demand supply mismatch in upcoming winter months remains a big threat), it may be time to be “cautiously bullish” for “Aggressive to Moderate” investors, and prepare to apportion 20-25% of available capital to large cap equities. An important point to note is this allocation would be an “Averaging” strategy, which could garner handsome returns with a view to remain invested for 3-5 yrs, irrespective of a further downside from hereon, wherein fresh Capital maybe deployed. “Conservative” investors may still hold on for Nifty to clear the levels mentioned below. The concerns like dark clouds hovering over the weakening INRUSD counter and untamed Inflation need to be closely watched though.

Technically, Nifty has to clear 16794-16896 and 17300 (most critical) “with conviction” for a confirmation of a new bull rally to take it to fresh highs (21500-22000 in 3 years or even less). But if it fails to do so, these levels would mark an end of a counter-trend rally and pave way to newer lows.

We’ll be coming up with the fresh Nifty Outlook in the coming days. This market commentary is for the guidance of our clients to start preparing for Capital allocation and for some exciting times ahead!

Disclaimers

(i) SEBI Unregistered

(ii) Equity Investments are subject to Market Risks

(iii) Please read our General Disclaimers carefully, which is a part of all our Client Reports. Please let us know if you would like a copy of the General Disclaimers separately.