Knowing the “Price” of Everything, but the “Value” of Nothing

Published on: August 16th, 2022

Vishal Ahuja, CWM® (USA)

Founder & Chief Analyst, Blue Lake Capital Management LLP || IIM Ahmedabad, 2007 || NiSM Certified Research Analyst || Practising Elliottician

“The stock market is filled with people who know the price of everything and the value of nothing.”

– Philip Fisher

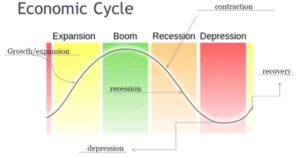

The Cycle of “Economic” Life

A global pandemic, global inflation, global recession, global supply chain disruptions, and global tensions. We are entering muddy waters, yet again…

People, plagued by their recency bias, always see their present situation as something novel. Often exaggerating and overly dramatizing their plights. The reality though is far from this perception. By spending time studying our collective history, it becomes evident that humanity managed to survive crisis after crisis. Unscathed? No. But despite the scars, it has become increasingly more innovative, more resilient, and – hopefully – wiser.

These strange times that we are traversing are not any different. The “wildfires” of this global chaos will expose points of fragility, and the structures that were bound to break will do so. Their inevitable death will make space for new, improved, and more adapted systems. More fit for the times ahead. New laws, new regulations, new mindsets, and new practices will be born from the ashes of the old ones.

The economy is not impervious to the “cycle of life” and, in Darwinian fashion, natural selection will wipe out the weaker specimen. Companies with poor practices and misallocated capital will either improve or face corporate death (aka bankruptcy). So what does it entail for us investors?

The good news is that bad times are temporary, the bad news is that good times aren’t immortal either.

Successful businesses that managed to weather countless tribulations throughout the years are well aware of the cyclicality of economic life. They actually anticipate the next downturn and make preparations while the proverbial halfwits are out partying. Low debt, high cash reserves, high productivity per employee, diversified client base, high margins, attractive products, steady R&D spending, and low marginal costs are some of the key signs of a high-quality business that an investor should be on the lookout for.

That is if your strategy is to buy and hold.

Rather, many others made fortunes by riding the upward momentum of high growth/low profitability (or rather no profitability) companies. And many more crushed their wallets when caught by surprise by the fizzling out of the enthusiasm surrounding these hype fuelled businesses.

Gravity is one of the four fundamental forces of nature, and markets are not impervious to it. So rather than deny its existence – as some ideologists enamored with the idea of “perpetual growth” want us to believe – why not work with it?

Success is calculated, and even though that calculation entails margins of error and the vagaries of chance, it is rarely an accident and more often than not the result of sound strategy.

As an investor, your dry powder left in the storage will only end up losing its potency. Capital needs to be allocated…wisely. As such, it is essential to determine the best strategy that fits your profile (risk tolerance, time horizon, etc.) and your current standing in the market cycle.

Value vs. Price

There is a fundamental point of debate in economics and that is the divergence that often exists between “value” and “price”. As basic economic agents, we are confronted on a daily basis with this problem:

“What?? ₹1000 for a pair of socks?! are they made of cashmere?!”

“What?? ₹500 for a 100g of cheese?! what a ripoff!”

“₹1500 for an SSD hard drive! What a bargain!”

These are common scenarios that everybody is exposed to, whether they are a procurement specialist working for a construction company seeking to purchase materials, or a fund manager looking to buy stocks.

This recurrent reaction to prices emerges from the apparent subjectivity of “value”. In your eyes, a diamond is just a shiny rock with little industrial applications and that should cost as much as it takes to take it out of the earth and process it. But your fiancée thinks otherwise, and the market will reflect her enthusiasm for the shiny rock by pricing it higher than you would.

Stocks are not impervious to subjective perceptions and often trade beyond (or below) their intrinsic value. Many models are used to determine a stock’s intrinsic value, but they all revolve around estimating the value of a stock’s future cash flows, earnings, book value, etc. That being said, the listed price of the stock on an exchange rarely matches your estimates. Hence we commonly refer to stocks as being “overvalued” or “undervalued’ (or “overpriced”/”underpriced” if you prefer).

You should keep this in mind when shopping for equities and draft up pertinent strategies that suit your goals and profile.

Investing vs. Trading

When playing the markets, all strategies can be boiled down to two fundamental declinations:

Investing and Trading.

Those are two separate games, and the lay investor always conflates them.

Those who can truly be qualified as Investors are playing the “value game”. Essentially, they are looking to buy assets when their price is below their fair value. Investors are in a sense looking for “bargains”. They are scouring markets, trying to find overlooked gems. Companies with sound financials and with unrealized potential are underpriced.

The underlying assumption of value investing is that at some point in the future, the market will wipe the proverbial dust off its eyes and the stocks will enjoy the newfound appreciation of their true worth. By its essence, value investing entails patience: it may take years before the price of a stock catches up with its true value.

Traders (or speculators) on the other hand, play the “pricing game”. Many traders have never looked at a company’s financials. By inference, they rarely care about the true value of a stock, rather they prefer to focus their attention on its current price and its expected near-term price. As such their holding time horizon is much shorter, anywhere from a few hours to several weeks.

Traders try to time the market, to “buy the dip” and then ride the upwards momentum of the stock. Of course, exiting the investment in a timely fashion is critical, or the speculator would risk seeing the market wipe out any profits he would have made.

Risk Capital

In today’s overinflated markets, many fancy themselves investors. They think that owning a few shares of whatever hot stocks or crypto assets is en vogue at the moment, and align them with the likes of Warren Buffett or the late Rakesh Jhujhunwala. As you probably suspect, the reality is far from this idealized view as the next economic downturn is sure to wipe out the majority of the makeshift “investors” overnight.

Their mistake: not knowing what game they were playing.

Most thought they were playing the investment game when they had worn a trader’s cap and undoubtedly failed to sense and time the market accordingly.

Were they “investors” in the true sense of the term, they would have spent time understanding the fundamentals of the business, estimating its intrinsic value, comparing their valuation to the current price, and deciding on their holding period while bracing for the inevitable emotional rollercoaster ride that the stock’s price-action will take them through.

“Amateurish” speculative investments are most prevalent in periods when risk capital is abundant. Risk capital is drawn to high returns over the shortest period possible. During these times, access to capital is cheap and it fuels a speculative bubble throughout the economy. Everyone and their grandmother is joining the party; ridiculous businesses get access to easy funding; companies overhire and overstretch; real estate developers build frantically without concern for actual sales, and retail investors bet their monthly wage on whatever is the trendiest tech stock that is making the headlines at the moment. In this environment, prices overshoot and the shrewd traders sensing a correction leave the infamous party before the bouncers (read Bears) start kicking everybody out.

In light of the above, tracking risk capital becomes a great tool to predict the market’s future movements.

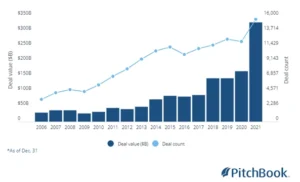

US venture capital investments hit a record year in 2021

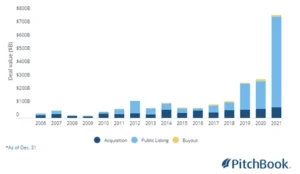

The surge in public listings for exits (USA)

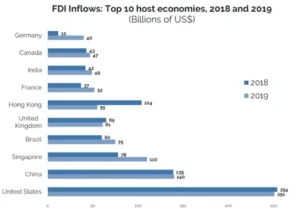

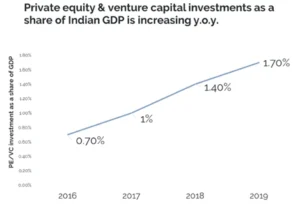

Are interest yields high or low? Is FDI / FPI especially high at the moment? Are venture capitalists particularly active? Are businesses accessing capital with relative ease or do they have to struggle to get funding? All of these questions will help you assess the current market conditions and navigate the path ahead. Speculators will get the message to exit the market and investors will figure out to hold on to their dry powder and wait for the inevitable correction to purchase quality assets on the cheap.

From the above charts, we can notice that India is becoming more attractive to risk capital, which in and of itself is a good thing. That being said, when risk capital becomes too abundant and too easy to access, misallocations become prevalent, prices surge and a correction becomes inevitable.

“When the tide goes out, you find out who is swimming naked”

– Warren Buffett